kv2-site.online

Recently Added

Crat Trust

Charitable remainder annuity trusts (CRAT) allow a grantor to create a trust that generates income until the beneficiary dies, then later transfers the assets. Charitable Remainder Annuity Trust (CRAT). Charitable Remainder Trusts(opens in new window) are irreversible trusts that let taxpayers donate assets to. A charitable remainder trust (CRT) is an irrevocable trust that generates a potential income stream for you, as the donor to the CRT, or other beneficiaries. This visual is used to show how a Charitable Remainder Annuity Trust (CRAT) can be used to provide income and estate tax relief for those who are charitably. A charitable remainder annuity trust (CRAT) is a type of gift transaction in which a donor contributes assets to a charitable trust. Charitable remainder trusts allow you to irrevocably transfer trust assets. A charitable remainder annuity trust (CRAT) pays a set income amount to. A CRAT is an estate planning tool where a donor receives income for a fixed period and donates the remainder to a charity. To establish a Charitable Remainder Annuity Trust (CRAT), the donor transfers cash or appreciated assets to a trustee to be held for the benefit of the RMS. Definition A charitable remainder trust is a separate legal entity created to hold and invest assets that will ultimately pass to Clarkson. Charitable remainder annuity trusts (CRAT) allow a grantor to create a trust that generates income until the beneficiary dies, then later transfers the assets. Charitable Remainder Annuity Trust (CRAT). Charitable Remainder Trusts(opens in new window) are irreversible trusts that let taxpayers donate assets to. A charitable remainder trust (CRT) is an irrevocable trust that generates a potential income stream for you, as the donor to the CRT, or other beneficiaries. This visual is used to show how a Charitable Remainder Annuity Trust (CRAT) can be used to provide income and estate tax relief for those who are charitably. A charitable remainder annuity trust (CRAT) is a type of gift transaction in which a donor contributes assets to a charitable trust. Charitable remainder trusts allow you to irrevocably transfer trust assets. A charitable remainder annuity trust (CRAT) pays a set income amount to. A CRAT is an estate planning tool where a donor receives income for a fixed period and donates the remainder to a charity. To establish a Charitable Remainder Annuity Trust (CRAT), the donor transfers cash or appreciated assets to a trustee to be held for the benefit of the RMS. Definition A charitable remainder trust is a separate legal entity created to hold and invest assets that will ultimately pass to Clarkson.

A Standard Document creating a charitable remainder annuity trust (CRAT) for a settlor residing in Pennsylvania with an annuity period based on concurrent. Generally, if the trust is for a term of years rather than for life, the income tax deduction will be larger. If the present value of the remainder interest. A Standard Document creating a charitable remainder annuity trust (CRAT) with an annuity period based on one measuring life that can be customized for use. A charitable remainder annuity trust (CRAT) pays a specific dollar amount each year. The amount is at least 5% and no more than 50% of the value of the corpus . A charitable remainder annuity trust is a way for individuals to support charities while earning an income. Learn more here. A charitable remainder trust (CRT) is an irrevocable trust that generates a potential income stream for you, as the donor to the CRT, or other beneficiaries. There are two basic differences between CRATs and CRUTs. First, the payments from a CRAT are based upon a fixed percentage of the original trust assets. For. If you have any questions about Charitable Remainder Annuity Trusts or any other estate planning topics, please contact us to schedule a free consultation. CRATs (Charitable Remainder Annuity Trusts) offer fixed annual annuity payments and prohibit additional contributions after establishment. Conversely, CRUTs . Dartmouth offers two types: a charitable remainder unitrust, or CRUT, pays a variable stream of income; a charitable remainder annuity trust, or CRAT, pays a. A charitable remainder trust (CRT) allows donors (aka grantors) to make a tax-deductible gift to charity while also generating income for themselves or their. A charitable remainder annuity trust (CRAT) is a popular type of life-income plan. Cash and securities are typical assets transferred into the trust. The. trust (CRAT). Annual CRUT payments are based on a fixed percentage of the fair market value of the trust assets and are revalued each year, possibly acting. trust assets at the end of the trust term. The donor receives an immediate income tax charitable deduction when the CRT is funded based on the present value. A CRAT is a type of irrevocable trust that is created to pay a fixed annuity based on a percentage of the initial FMV of the property transferred to the. A Charitable Remainder Annuity Trust (CRAT) is a Planned Giving vehicle defined in § of the United States Internal Revenue Code. A Charitable Remainder Annuity Trust (CRAT) is a Planned Giving vehicle defined in § of the United States Internal Revenue Code. A CRAT offers a steady stream of income for the remainder of your life while giving you a way to donate to your favorite charity. A charitable remainder annuity trust (CRAT) may appeal to donors who want to make a gift now, but would like to receive fixed payments for life or for a. A Standard Document creating a charitable remainder annuity trust (CRAT) with an annuity period based on concurrent and consecutive interests for two.

How To Get Financing For A Manufactured Home

The mobile home must be affixed to a permanent foundation, with the wheels, axels, and hitches removed. · The mobile home must be a year-round home and be. Refinancing your manufactured home can significantly lower your monthly payments and lower the interest rate on your mortgage. Contact us to talk about a. Financing for manufactured homes that are permanently attached to land (known as Type I manufactured homes) is available under most single-family loans. First Fed directly offers conforming manufactured home loans. Our lending experts are here to walk you through the process and find the best terms for your. Check out the listings below to find a lender in Kentucky that can help you find the right manufactured home loan. Check out the listings below to find a lender in Tennessee that can help you find the right manufactured home loan. 5 types of loans for buying a manufactured home ; Minimum credit score, , , with % down, with 10% down, Varies by lender ; Must be titled as real. Even if you don't own your own land free and clear but have equity, you can use the equity with your financing package. Let our team help you maneuver through. Manufactured homes are an affordable way to achieve your dream of owning a quality home. Our manufactured home loan at Sound Community Bank is perfect. The mobile home must be affixed to a permanent foundation, with the wheels, axels, and hitches removed. · The mobile home must be a year-round home and be. Refinancing your manufactured home can significantly lower your monthly payments and lower the interest rate on your mortgage. Contact us to talk about a. Financing for manufactured homes that are permanently attached to land (known as Type I manufactured homes) is available under most single-family loans. First Fed directly offers conforming manufactured home loans. Our lending experts are here to walk you through the process and find the best terms for your. Check out the listings below to find a lender in Kentucky that can help you find the right manufactured home loan. Check out the listings below to find a lender in Tennessee that can help you find the right manufactured home loan. 5 types of loans for buying a manufactured home ; Minimum credit score, , , with % down, with 10% down, Varies by lender ; Must be titled as real. Even if you don't own your own land free and clear but have equity, you can use the equity with your financing package. Let our team help you maneuver through. Manufactured homes are an affordable way to achieve your dream of owning a quality home. Our manufactured home loan at Sound Community Bank is perfect.

FHA loans are available for financing or refinancing manufactured homes with terms of up to 30 years and loans that offer low down payments and loosened credit. NHA's members include manufactured home lenders in Washington. If you need financing for your manufactured home, they can help! 21st Mortgage Corporation is a full service lender specializing in manufactured home loans. We underwrite, originate, and service our own loans. How do you qualify for a manufactured home loan? · Manufactured on or after June 15, , to be considered for financing · Placed on property owned by the. How to Apply · Call HOME () or click here to connect with the SONYMA team · Email [email protected] VA allows a seller such as Florida Modular Homes to pay for all the borrowers closing cost as well. Florida Modular Homes appreciates all that our Veterans have. Lenders look for a credit score within the “good” range to approve a borrower for a manufactured home loan. A higher credit score may also result in a lower. Land/Home Financing · Allows you to finance the purchase of your lot and your manufactured home · Includes conventional, Federal Housing Administration (FHA). 2) GET A USDA, VA, OR FHA CONSTRUCTION LOAN. There are many great government backed loan options available today. An FHA Construction Loan has a % minimum. What is a Manufactured Home Loan? · Purchase only · year term · Minimum credit score of · Property must have the title available or have been converted to. Manufactured homes can ease the nation's affordable housing shortage and Fannie Mae MH Advantage loans are a vehicle lenders can provide to homeowners. Buyers of manufactured homes may apply for a loan through a HUD-approved lender or through a lender's approved manufactured home dealer. Funding Status. This is Fannie Mae / Freddie Mac backed loan and can be used for purchasing or refinancing an existing home. The minimum down payment is typically 5% and the. IMHA's members include manufactured home lenders in Indiana. If you need financing for your manufactured home, they can help! A minimum of 10% down, plus loan closing costs, is usually required for a manufactured or mobile home. FHA loans can be closed with as little as % down. Welcome Home Loans are long-term, fixed-rate mortgage loans for manufactured-homes. They are unique because of the low downpayment, no age limit on the home, no. Check out the listings below to find a lender in Michigan that can help you find the right manufactured home loan. RMHA's members include manufactured home lenders in Colorado. If you need financing for your manufactured home, they can help! Construction requirements for FHA manufactured home loans · The home site has access to water and sewer facilities · The site has all-weather access · The.

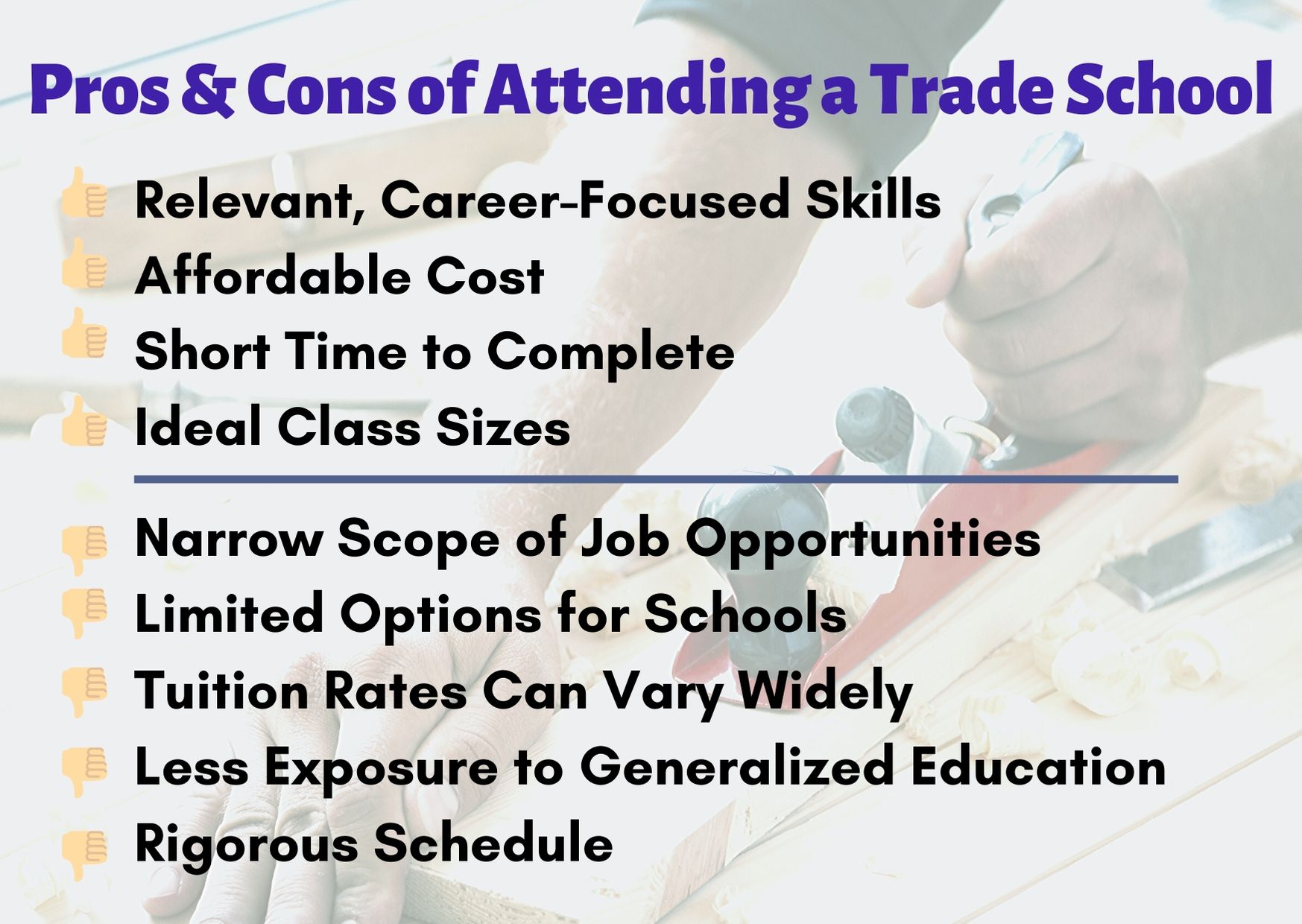

Names Of Trade Schools

Explore some of the best vocational and trade schools for We discuss popular trade school degrees and explain what to expect. Name Email Address School Information Needed. Thank you! Your submission has been received! Oops! Something went wrong while submitting the form. Programs. SkilledTradesBC manages nearly 90 trades programs in BC, 48 of which are Red Seal. Browse or search for programs on this page. Texas Trade Schools and Technical Colleges · Tulsa Welding School. Dallas, TX · South Texas Vocational Technical Institute. Brownsville, TX · Aviation Institute of. New Jersey's county vocational-technical schools are the choice for students who want more out of high school. Join Our Mailing List. The owner of this. Phagan's School of Hair Design is one of Oregon's best-known names in cosmetology education, and the Portland campus is arguably the gem of the network. The. Top 10 Best Trade Schools in New York, NY - September - Yelp - Fullstack Academy, Technical Institute of America, App Academy NYC, Berk Trade. In this collection, you'll find 50+ catchy brand names for vocational & technical schools that will help you attract the best and brightest students. List of vocational colleges in the United States · Brown Mackie College · Culinard · The Art Institute of Phoenix · Brown Mackie College · Pulaski Technical. Explore some of the best vocational and trade schools for We discuss popular trade school degrees and explain what to expect. Name Email Address School Information Needed. Thank you! Your submission has been received! Oops! Something went wrong while submitting the form. Programs. SkilledTradesBC manages nearly 90 trades programs in BC, 48 of which are Red Seal. Browse or search for programs on this page. Texas Trade Schools and Technical Colleges · Tulsa Welding School. Dallas, TX · South Texas Vocational Technical Institute. Brownsville, TX · Aviation Institute of. New Jersey's county vocational-technical schools are the choice for students who want more out of high school. Join Our Mailing List. The owner of this. Phagan's School of Hair Design is one of Oregon's best-known names in cosmetology education, and the Portland campus is arguably the gem of the network. The. Top 10 Best Trade Schools in New York, NY - September - Yelp - Fullstack Academy, Technical Institute of America, App Academy NYC, Berk Trade. In this collection, you'll find 50+ catchy brand names for vocational & technical schools that will help you attract the best and brightest students. List of vocational colleges in the United States · Brown Mackie College · Culinard · The Art Institute of Phoenix · Brown Mackie College · Pulaski Technical.

Best Trade Schools in Los Angeles, CA · Our Recommended Top 10 · Providers · Newport International United College · Harbor Occupational Center · National Career. Top Vocational Trade Schools in Phoenix · GateWay Community College · UEI College · The Refrigeration School · Vocational Training Institute. Phoenix, AZ Online. Long Island Trade Schools · Apprenticeship Training. David R Bluth Association · Automobile Driving Schools. All Time Driving School · Beauty Salons. Royal Beauty. Trade/Vocational Schools. School. Contact Information. Programs Offered more detailed list of programs. New York. Automotive. & Diesel. Institute. Top Vocational Trade Schools in New York City ; Lincoln Technical Institute. Queens, NY Campus Only · $31,–$47, per Program ; New York College of. View More Programs. Q&A About Trade Schools. Collapse All; Expand All. What is trade school? "Trade school" goes by many names and can take place in different. Website Developer. Welding. See Full List! Henry Ford College. HenryFord_xjpg. Trade Programs Offered: Advanced Manufacturing. Automotive Technology. Community Colleges: Many community colleges offer vocational programs in fields like welding, automotive technology, culinary arts. List of Approved Schools. Long Beach City College · North Orange Los Angeles Trade Technical College · Shasta Builder's Exchange · A vocational school, trade school, or technical school is a type of educational institution, which, depending on the country, may refer to either secondary. Trade Schools and Technical Colleges in New York · Lincoln Tech – Queens · College of Westchester – White Plains · St. Paul's School of Nursing – Queens, Staten. National Career College started in as the Dental Technology Institute of Southern California. They changed their name in and now offer a broader range. 4- College of Western Idaho, Mampa. See rankings for all trade programs in Idaho. Best trade schools in Illinois. There are 52 trade and. More schools in Chicago, Illinois · Triton College. 5th Ave River Grove, IL · Moraine Valley Community College. W. College Parkway Palos Hills, IL. New York Trade Schools ; AMG School of Licensed Practical Nursing, Brooklyn, ; Academy of Cosmetology and Esthetics NYC, Staten Island, 35 ; Access Careers. trade schools and other vocational schools operating. 'the schools are Addresses and even the names of schools are subject to change from time to. Trade schools, also known as Vocational schools or sometimes technical schools, are reliable vocational education sources that provide an alternative. Ask for the names and phone numbers of the school's licensing and accrediting organizations. Check with these organizations to learn whether the school is. A list and description of Texas vocational school, San Antonio TX. Earning your professional certification from a trade school is a fast and effective way to. Personal attention and personalized education—HoHoKus School of Trades and Technical names in the trades industries such as the American Welding Society.

Do You Have To Pay Taxes On Stimulus Checks

It's not too late to file a tax return to get the Recovery Rebate Credit! Click on any of the following links to jump to a section: How do I claim the Recovery. Q: I filed my income tax already. How do I get the rebate? The IRS does not consider the COVID stimulus checks income, which means that the extra amounts you received will not be taxed. EIPs are not considered taxable income, so you won't have to pay taxes on any amount you receive—and they won't reduce your refund when you file your tax. Children and adult dependents claimed on tax returns within these households are also eligible for $1, payments, including college students and some people. Stimulus checks are a tax-free boost from the government. This means you will not have to pay any tax on a stimulus check if you receive one. You don't even. You can claim the stimulus payments as a tax credit and get the money as part of your tax refund. The stimulus checks are a federal tax credit, known as the. If you have other taxable income, you would have to list that. Do not file a simplified return if you have taxable income. State only, no income return: Review. Payments are non-taxable. You will not be required to pay anything back next year. Getting your Economic Impact Payment. 8. How do I get my stimulus check? It's not too late to file a tax return to get the Recovery Rebate Credit! Click on any of the following links to jump to a section: How do I claim the Recovery. Q: I filed my income tax already. How do I get the rebate? The IRS does not consider the COVID stimulus checks income, which means that the extra amounts you received will not be taxed. EIPs are not considered taxable income, so you won't have to pay taxes on any amount you receive—and they won't reduce your refund when you file your tax. Children and adult dependents claimed on tax returns within these households are also eligible for $1, payments, including college students and some people. Stimulus checks are a tax-free boost from the government. This means you will not have to pay any tax on a stimulus check if you receive one. You don't even. You can claim the stimulus payments as a tax credit and get the money as part of your tax refund. The stimulus checks are a federal tax credit, known as the. If you have other taxable income, you would have to list that. Do not file a simplified return if you have taxable income. State only, no income return: Review. Payments are non-taxable. You will not be required to pay anything back next year. Getting your Economic Impact Payment. 8. How do I get my stimulus check?

As for upcoming payments, under the terms of the American Rescue Plan, your $1, stimulus check cannot be garnished for unpaid federal or state debt. However. Do you need to pay taxes on the rebate? If you took the standard deduction, you won't need to take any action on your federal return related to the rebate. Even if you have no income, you are still eligible, but need to file taxes to receive your stimulus payment. This includes individuals with low or no. How will I receive my rebate? You can expect to receive your rebate based on how you received your tax year refund, by direct deposit or paper check. If. Yes, if you owe more than $ in a public assistance case or more than $ in a non-public assistance case, federal law requires that the IRS withhold some. The COVID-related Tax Relief Act of , enacted in late December , authorized additional payments of up to $ per adult for eligible individuals and up. No, according to the IRS, stimulus checks are non-taxable income, which means that you won't have to include the amount in your calculation of taxable income. No, you will not have to repay your relief check. It also won't be taken out of any tax refund you may be expecting when you file your return. Are the rebates subject to Arizona individual income tax? (UPDATED 12/27/23). No, the third stimulus payment is considered a tax credit (Recovery Rebate Credit), not income, so you will not need to pay taxes on it or pay it back. Q. How do I get it? · The stimulus payments will be processed by the IRS. · If you have already filed a tax return, you will get the stimulus payment. Here's what you need to know about past payments and the next one that's expected: · If a third payment is approved and you're eligible, most people will receive. If you filed a tax return in or , you do not have to do anything else. The IRS will send you a payment. If you already get direct deposit with the IRS. Are the Stimulus Payments Taxable? Let's get the good news out of the way: No, you won't have to pay tax on any of your coronavirus-related stimulus payments. No, according to the IRS, stimulus checks are non-taxable income, which means that you won't have to include the amount in your calculation of taxable income. I need help getting a rescue payment. A typical family of 4 with a household income of $, is eligible for an average of $5, in rescue funds. Claim your. But if you are missing a payment from the third round, you can still file a tax return and claim the Recovery Rebate Credit on Line 30 of IRS Form ! States don't consider these payments as taxable income on the state tax return. However, the federal government (the IRS) might, depending on your state. The rebate is treated like other refundable tax credits and not considered income, so it will not be taxed. How much will I get and when? Each eligible adult in.

Does Marriage Counseling Save Marriages

Attending marriage therapy can help release feelings of resentment and frustration before they become damaging to your relationship. Because divorce is one of the most stressful events a family will experience, it's important to explore all avenues that may save your marriage. Many marriages. Traditional Marriage Counseling Won't Help. It stirs up problems and destroys trust. Traditional Marriage Counseling Will Make Your Marriage Worse. Marriage counselors can play a significant role in saving a marriage by helping couples identify and address the underlying issues that cause conflicts in. While your relationship is at its most fragile point, your therapist can help restore trust and help reinforce the foundation of your love. A marriage counselor. What marriage counseling does is help the married couple understand the root of the problem in their marriage. After realizing the issues affecting the marriage. Does it work? Research suggests that couples counselling can be effective in helping relationships. Two studies consider marriage counselling to be an effective. Unfortunately, there is not a simple yes or no answer I can give. Nothing about fixing a marriage after an affair can be generalized. Have some marriages. When asking “does marriage counseling work?”, statistics show that the answer is usually yes when couples use EFT. EFT works by helping a couple understand and. Attending marriage therapy can help release feelings of resentment and frustration before they become damaging to your relationship. Because divorce is one of the most stressful events a family will experience, it's important to explore all avenues that may save your marriage. Many marriages. Traditional Marriage Counseling Won't Help. It stirs up problems and destroys trust. Traditional Marriage Counseling Will Make Your Marriage Worse. Marriage counselors can play a significant role in saving a marriage by helping couples identify and address the underlying issues that cause conflicts in. While your relationship is at its most fragile point, your therapist can help restore trust and help reinforce the foundation of your love. A marriage counselor. What marriage counseling does is help the married couple understand the root of the problem in their marriage. After realizing the issues affecting the marriage. Does it work? Research suggests that couples counselling can be effective in helping relationships. Two studies consider marriage counselling to be an effective. Unfortunately, there is not a simple yes or no answer I can give. Nothing about fixing a marriage after an affair can be generalized. Have some marriages. When asking “does marriage counseling work?”, statistics show that the answer is usually yes when couples use EFT. EFT works by helping a couple understand and.

Although most marriage and family therapists stand for marriage and wish every one could be saved, we know that not every marriage can or should be saved. I know from experience, because I too was frustrated with such a low rate of success. I sincerely desired to help my clients to save their marriages. But, the. Couples therapy gives couples a safe environment to communicate with each other. The therapist prevents them from repeating harmful communication patterns. A. I later discovered that a common statistic is that 75% of marriage counselling leaves couples worse off or divorced after. For literally 's. Research shows that couples who seek couples therapy increase their chance of staying together. They also improve communication and satisfaction in their. Although most marriage and family therapists stand for marriage and wish every one could be saved, we know that not every marriage can or should be saved. Counseling and Guidance. Counselors. Finding a counselor can often be an overwhelming task. We have compiled a number of helpful resources to help you. If both participants want marriage counseling to work, then the answer to the question, “does marriage counseling save marriages,” is a resounding yes. Does. Stats show marriage counseling has a high rate of success. Learn what you get in therapy and look at the hard numbers here. The world's most practical pre-marriage assessment. Perfect for pre-engaged, engaged and newly married couples. The future of premarital assessments. A good couples counselor will help both get insights into your stuck patterns of behavior and what you do to sabotage your relationship. Roughly 50% of distressed couples will have an improved, more satisfying marriage for 4+ years after counseling. · Divorce rates after marriage counseling vary. Unfortunately, there is not a simple yes or no answer I can give. Nothing about fixing a marriage after an affair can be generalized. Have some marriages. Having been the marriage counselor who creates safety for couples to have those kinds of new conversations, I've had the honor and privilege of witnessing the. Couples therapy is short-term counseling. It's provided by licensed therapists trained to help couples resolve conflicts. An effective therapist helps couples. How can you know if your marriage can be saved, and if you can feel happy with your spouse again? Well, the good news is that most marriages can be saved. But. These therapists believe in helping couples restore their marriages to health if that is possible. Most couples assume this is what all therapists believe. But. Builds understanding and empathy in your relationship: Going to couples counseling can help you understand your partner better. Over several counseling sessions. When both parties are receptive to change, couples therapy can be beneficial to the relationship. In the s, therapy for couples had a 50% chance of success. I later discovered that a common statistic is that 75% of marriage counselling leaves couples worse off or divorced after. For literally 's.

1 2 3 4