kv2-site.online

Community

How Do I Take Credit Cards For My Business

How to accept credit cards online · Easy integration: Incorporating the online payment options into your online store or website should be straightforward. · E-. Many merchants in the US do accept credit cards. However, some of them do not want to incur the associated fees required to process the transactions. Small businesses can accept credit card payments by using an online merchant gateway like Stripe or PayPal, by setting up a POS system with a merchant account. What do I do if I suspect there has been an unauthorized transaction on my business credit card? How do I add or remove an employee from my account?Expand. To. Accept Credit Cards on a Website · Popular Credit Card Processor: Stripe · Accept Credit Cards with a Complete eCommerce Platform · The Best Way for Your Business. Small business credit cards provide business owners with easy access to a revolving line of credit with a set credit limit in order to make purchases and. In order to be able to take payments online, you need to set yourself up with a payment processor or a credit card processing provider who will handle all of. How to Accept Credit Cards for Your Small Business · 1. Sign Up With a POS provider · 2. Purchase Hardware · 3. Set Up Your POS system · 4. Test Your POS System · 1. If you desire the ability to accept credit card payments from friends, family or other people you trust – such as the friends you split the bill with at dinner. How to accept credit cards online · Easy integration: Incorporating the online payment options into your online store or website should be straightforward. · E-. Many merchants in the US do accept credit cards. However, some of them do not want to incur the associated fees required to process the transactions. Small businesses can accept credit card payments by using an online merchant gateway like Stripe or PayPal, by setting up a POS system with a merchant account. What do I do if I suspect there has been an unauthorized transaction on my business credit card? How do I add or remove an employee from my account?Expand. To. Accept Credit Cards on a Website · Popular Credit Card Processor: Stripe · Accept Credit Cards with a Complete eCommerce Platform · The Best Way for Your Business. Small business credit cards provide business owners with easy access to a revolving line of credit with a set credit limit in order to make purchases and. In order to be able to take payments online, you need to set yourself up with a payment processor or a credit card processing provider who will handle all of. How to Accept Credit Cards for Your Small Business · 1. Sign Up With a POS provider · 2. Purchase Hardware · 3. Set Up Your POS system · 4. Test Your POS System · 1. If you desire the ability to accept credit card payments from friends, family or other people you trust – such as the friends you split the bill with at dinner.

What do you need to apply for a business credit card? · Your full name, residential address, date of birth, Social Security Number, and contact info · Your. Find the right Visa small business credit card and discover payment technologies, reporting tools and more to help your business succeed. Accelerate your business. Take advantage of credit cards and short-term financing to drive your business growth. Save time and money with streamlined. Your business can accept online credit card payments in two ways – through your own online business or a third-party website. How to accept credit cards and pay fewer fees · 1. Know that you can write off credit card processing fees at tax time! · 2. Get competitive rates when you accept. Find small business credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits your needs. A surprising number of companies (nearly 50%) don't accept credit cards for payments from their customers. Although you may think it's a hassle to accept. Credit cards can be a useful tool for your business, as long as they're used appropriately. Business cards often will offer better rates than personal cards. Choose from a variety of credit cards designed to meet your small business needs. Earn rewards, improve cash flow, and track payments easily. Apply online. The option you choose may depend on the type of business that you run. For example, if you have a brick-and-mortar retail store, you may accept credit cards in. Eligible Small Businesses can accept through your provider, which sets the rate for card acceptance. Plus receive a single statement and deposit, the same way. QuickAccept is a built-in credit card processing feature of Chase Business Complete Banking that lets you accept payments anywhere in the U.S. Moneris to accept debit and credit card payments. Royal Business Does a business or commercial credit card build my business credit score? Explore today! Fast, easy approval. We take pride in a quick turn around time for approvals. When do I make my credit card payment? Each month, you will. Payment service providers like Square, Stripe, and PayPal let businesses accept credit card payments without the hassle of applying for a merchant account. Business to consumer companies leverage credit cards on a daily basis to get paid easier. However, because of various factors, businesses typically still use. Accelerate your business. Take advantage of credit cards and short-term financing to drive your business growth. Save time and money with streamlined. Accept Visa card payments in-store To start accepting Visa cards find a payment provider licensed by Visa, and set up an appointment to discuss a merchant. Becoming a Visa Merchant Once you decide to accept Visa cards, an Acquirer/Payment Processor will provide hardware, software and systems that work best for.

How To Determine Interest

Interest can be calculated in three basic ways. Simple interest is the easiest calculation, generally for short-term loans. Compound interest is a bit more. Calculate simple interest using the formula I = P * r * t, where I is the interest, P is the principal amount, r is the annual interest rate (in decimal form). In order to calculate the monthly interest charges to your balance you simply need to multiply this daily periodic rate by the number of days in your billing. In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of. The EFFECT function returns the compounded interest rate based on the annual interest rate and the number of compounding periods per year. Here is the formula to calculate interest on the income statement: Interest Expense = Average Balance of Debt Obligation x Interest Rate. The interest rate formula is Interest Rate = (Simple Interest × )/(Principal × Time). What is the Formula to Calculate the Interest Rate Formula? The. Simple interest is a method to calculate the amount of interest charged on a sum at a given rate and for a given period of time. The formula to determine simple interest is an easy one. Just multiply the loan's principal amount by the annual interest rate by the term of the loan in years. Interest can be calculated in three basic ways. Simple interest is the easiest calculation, generally for short-term loans. Compound interest is a bit more. Calculate simple interest using the formula I = P * r * t, where I is the interest, P is the principal amount, r is the annual interest rate (in decimal form). In order to calculate the monthly interest charges to your balance you simply need to multiply this daily periodic rate by the number of days in your billing. In finance and economics, interest is payment from a debtor or deposit-taking financial institution to a lender or depositor of an amount above repayment of. The EFFECT function returns the compounded interest rate based on the annual interest rate and the number of compounding periods per year. Here is the formula to calculate interest on the income statement: Interest Expense = Average Balance of Debt Obligation x Interest Rate. The interest rate formula is Interest Rate = (Simple Interest × )/(Principal × Time). What is the Formula to Calculate the Interest Rate Formula? The. Simple interest is a method to calculate the amount of interest charged on a sum at a given rate and for a given period of time. The formula to determine simple interest is an easy one. Just multiply the loan's principal amount by the annual interest rate by the term of the loan in years.

An example of calculating APR on a loan. First, add $1, and $ 1. Find the interest rate and charges. For the APR formula, you'll. Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment. How to calculate your loan cost. As a borrower, your loan cost primarily comes down to the loan amount you are seeking with determined interest. There are. For example, if the simple interest rate is 5% on a loan of $1, for a duration of 4 years, the total simple interest will come out to be: 5% x $1, x 4. The equation for calculating interest rates is as follows: Interest = P x R x N. Where P equals the principal amount (the beginning balance), and R stands for. Use the calculator below to calculate interest payments. The Gatehouse Chambers online calculators are provided for you to use free of charge. We can use the interest formula of compound interest to ease the calculations. To calculate compound interest, we need to know the amount and principal. It is. It's easy. Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time. You calculate the simple interest by multiplying the principal amount by the number of periods and the interest rate. Simple interest does not compound, and you. A simple interest calculator uses the formula I = P x R x T, where I is the interest earned or paid, P is the principal amount, R is the interest rate, and T. Simple interest is calculated on the principal, or original, amount of a loan. · Compound interest is calculated on the principal amount and the accumulated. Simple interest formula. Here is the mathematical formula, on which a simple interest calculator works to compute the loan amount: · A = P (1+RT). To calculate. Mr. A has invested an amount of Rs. at an interest rate of 5% for almost 2 years. So his SI will be calculated as Rs. Step 1: Identify the total amount of simple interest accrued, I, the principal amount, P, and the number of time periods that have passed, t. You can calculate the simple interest rate by taking the initial deposit or principal, multiplying by the annual rate of interest and multiplying it by time. The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months. Interest rate; Number of payments, and; Amount of money you need to borrow (the principal). To calculate any of these items, simply leave. The formula to calculate simple interest is made up of multiplying three factors: principal amount, rate, and time. How do I calculate late payment interest? To calculate the interest due on a late payment, the amount of the debt should be multiplied by the number of days for.

Receive Payment Via Credit Card

We will explore some of the cheapest ways to accept credit card payments, helping businesses expand their payment options while keeping costs to a minimum. Generally, it takes two to four business days for payments to be processed from the customer's card, through the bank and to your account. Plastiq lets buyers pay on their terms and vendors receive payment on their terms, while providing everyone access to the benefits of credit. To accept credit card payments in-person or in-store, usually requires a Point-of-Sale (POS) system with a card reader, or a credit card terminal that can. Effectively, it is the same as payment processing, but involves the buyer paying with a credit card online, in-person, or through a virtual terminal like Pay by. Accept credit card payments, get your invoices paid and see money in your bank account in a few days. Wave makes getting paid fast, frictionless, and fun. Accept one-time and recurring credit card payments through customizable payment forms, a state-of-the-art Point-of-Sale system, or on a mobile device with the. Accepting online credit card payments with PayPal. Paypal was one of the first companies to allow businesses to accept credit card payments without a merchant. kv2-site.online lets you accept credit cards and many other payment methods directly through your website, making the process as easy as possible. You can accept credit. We will explore some of the cheapest ways to accept credit card payments, helping businesses expand their payment options while keeping costs to a minimum. Generally, it takes two to four business days for payments to be processed from the customer's card, through the bank and to your account. Plastiq lets buyers pay on their terms and vendors receive payment on their terms, while providing everyone access to the benefits of credit. To accept credit card payments in-person or in-store, usually requires a Point-of-Sale (POS) system with a card reader, or a credit card terminal that can. Effectively, it is the same as payment processing, but involves the buyer paying with a credit card online, in-person, or through a virtual terminal like Pay by. Accept credit card payments, get your invoices paid and see money in your bank account in a few days. Wave makes getting paid fast, frictionless, and fun. Accept one-time and recurring credit card payments through customizable payment forms, a state-of-the-art Point-of-Sale system, or on a mobile device with the. Accepting online credit card payments with PayPal. Paypal was one of the first companies to allow businesses to accept credit card payments without a merchant. kv2-site.online lets you accept credit cards and many other payment methods directly through your website, making the process as easy as possible. You can accept credit.

Accept one-time, recurring, and mobile credit card payments with PaySimple - software that keeps your small business moving. This guide will walk you through the ins and outs of the credit card processing industry and highlight the factors you must consider when choosing a processor. The payment processor receives the batch sent by the merchant, sorts the transactions, and transmits them to the appropriate credit card network. Transactions. The company/issuing bank can check if the client has access to available credit and approve or reject the transaction. You can also collect Credit Card payments. This article covers how to accept credit card payments and the methods you can use to get paid in person, online, and remotely. Allowing customers to pay with their credit card on your website is the most basic way to accept payments online. To do this, you need to decide whether to have. If you want to offer this option to your customers, you'll need a card reader with an EMV chip card payment terminal. Note that if you accept in-person payments. Here are the three basic options we'll explore: 1) Absorbing the fees as a cost of doing business 2) Increasing your rates to cover the cost of the fees 3). How to take credit card payments in person. Once you have all the necessary software and hardware, you can start accepting credit card payments. Connect your. Credit and debit card payments can be made in person, over the phone, or online and involve several steps with multiple intermediaries, each adding a fee to. This guide will walk you through the process, giving you all the information you need to find the right match for your business. To accept credit cards online or in person, you need a payment service provider (PSP) that lets you safely process transactions from popular card networks like. Acquiring Bank - A registered member of the card associations. The acquiring bank approves a merchant to accept credit card payments by evaluating the. This article will give you the information you need to start accepting credit card payments as soon as possible. In this blog post, we're going to tell you everything you need to know about accepting credit card payments as a small business. These devices are equipped with the necessary tech to communicate with a debit or credit card, allowing them to accept card payments – or decline them if the. The Steps Required for Accepting Credit Card Payments · Step 1: Make Sure Your Website Is Compatible with E-Commerce · Step 2: Choose a Payment Processor · Step. In this guide, we'll walk you through the ins and outs of credit card payment acceptance, from understanding the key concepts to choosing the right solutions. A payment processor takes the credit card information it receives from the payment gateway and sends it to the credit card network. After checking for fraud and.

How To Put Your Business On Google Maps

1. Sign into your Google account. 2. Open Google Local Maps. Find the link - Get Your Free Business Listing Stand Out on Google 3. Find the exact location of. To boost your local positions, enrich your website with local keywords. These are the keywords that let Google see your relevance to a certain location. Find. Sign in to Google Maps. · At the top-left, click on the three horizontal lines. · Click "Add your business". · Follow the instructions to finish. Google Business Profile is a free profile that allows businesses to appear in Google Maps and engage with customers for free. How to Add Social Media Links to Your Google Business Profiles. May 17, Redefining Comarketing Through AI · Article. Click Add Single Business on the dropdown menu. A drop down menu will appear once you have clicked the Add Business button. Since you're adding and verifying. Go to Google My Business. Click “Get on Google”. Enter Your Business Name and Address in the Search Box. Select or Add Your Business. Click on. Get your business on Google for free with Google Business Profile. Right-click anywhere on the map and then tap Add your business;; Select the menu in the upper left corner, then tap. 1. Sign into your Google account. 2. Open Google Local Maps. Find the link - Get Your Free Business Listing Stand Out on Google 3. Find the exact location of. To boost your local positions, enrich your website with local keywords. These are the keywords that let Google see your relevance to a certain location. Find. Sign in to Google Maps. · At the top-left, click on the three horizontal lines. · Click "Add your business". · Follow the instructions to finish. Google Business Profile is a free profile that allows businesses to appear in Google Maps and engage with customers for free. How to Add Social Media Links to Your Google Business Profiles. May 17, Redefining Comarketing Through AI · Article. Click Add Single Business on the dropdown menu. A drop down menu will appear once you have clicked the Add Business button. Since you're adding and verifying. Go to Google My Business. Click “Get on Google”. Enter Your Business Name and Address in the Search Box. Select or Add Your Business. Click on. Get your business on Google for free with Google Business Profile. Right-click anywhere on the map and then tap Add your business;; Select the menu in the upper left corner, then tap.

If you see the text, “Own this business?” underneath your listing, you're not verified. You'll typically get options on how you want to get verified, whether it. Click Add Single Business on the dropdown menu. A drop down menu will appear once you have clicked the Add Business button. Since you're adding and verifying. Beyond a URL and description, you can add business photos, videos, telephone numbers, business hours, a delivery area, and links to reservation services. A. Get your business hours, phone number and directions on Google Search and Maps with a Google Business Profile. List your business on Google with a free Business Profile. Turn people who find you on Search & Maps into new customers. If you already know your church isn't listed, click the "Add your business to Google" button. Add Church to Google Maps. You'll be asked to enter basic. Why Is My Business Not Showing On Google Maps? · It Isn't Relevant To The Search Query · It's Too Far Away From Where You're Searching For It · It Isn't High. If you see the text, “Own this business?” underneath your listing, you're not verified. You'll typically get options on how you want to get verified, whether it. Claim your local business Manage how your business appears on Google Maps and Google Search by claiming your Business Profile. Once you verify yourself as the. your free Business Profile on Google Search and Maps. Find the right tools for your small business. Get started with your step-by-step Digital Essentials Guide. To get your new business on Google Maps, you must add it to your Google Business Profile. But if you have an established business, it is likely already on. You can add your company on Google Maps directly or through your Google Business Profile (old Google My Business). 1. Go to Google My Business. Google My Business 2. Enter Your Business Name and Address in the Search Box. Google My Business 3. Select or Add Your Business. your free Business Profile on Google Search and Maps. Find the right tools for your small business. Get started with your step-by-step Digital Essentials Guide. 1. Go to · 2. Write your restaurant's name into the “Search Box” · 3. Enter your restaurant's location · 4. Choose the category that fits your business best · 5. How to add your business to Google Maps · 1. Claim or create your Business Profile on Google · 2. Verify your local business on Google · 3. Make your profile. If your business does not appear in the search results, click on “Add new place.” If you're creating a new listing or adding a missing place, you have to fill. Go to Google Business Profile in your site's dashboard. Click + Add New Business at the top right and add your other location(s). To add another location you. At the top left corner of your Business Profile Manager, click on the “Businesses” option. Click on 'Create Group'. Click on 'Add Locations'. 2. Add. 1. Go to · 2. Write your restaurant's name into the “Search Box” · 3. Enter your restaurant's location · 4. Choose the category that fits your business best · 5.

How To Start Roth Ira Account

A Roth IRA is a retirement account where you may be able to contribute after-tax dollars and you don't have to pay federal tax on “qualified distributions” (as. No minimum to open an account—invest with as little as $10 · $0 advisory fee for balances under $25K (% for balances of $25K+) · Designed for investing goals. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. An E*TRADE Roth IRA lets you invest your way. Our Roth IRA lets you withdraw contributions tax-free at any time. Open a Roth IRA with us today. Secure your financial future with Vanguard's Roth IRA–tax-free growth potential for retirement savings. Discover the benefits and how to open a Roth IRA. A Roth Individual Retirement Account (IRA) is funded with money you've already paid taxes on. Growth on that money, as well as your future withdrawals, are then. More In Retirement Plans · You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make. A Roth IRA allows you to deposit money into your account after you've paid income taxes on it. The money then grows there tax-free. Should you consider a. If your income is too high for a Roth IRA, you could get to a Roth through the "back door." To use this strategy, you'd start by placing your contribution in a. A Roth IRA is a retirement account where you may be able to contribute after-tax dollars and you don't have to pay federal tax on “qualified distributions” (as. No minimum to open an account—invest with as little as $10 · $0 advisory fee for balances under $25K (% for balances of $25K+) · Designed for investing goals. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. An E*TRADE Roth IRA lets you invest your way. Our Roth IRA lets you withdraw contributions tax-free at any time. Open a Roth IRA with us today. Secure your financial future with Vanguard's Roth IRA–tax-free growth potential for retirement savings. Discover the benefits and how to open a Roth IRA. A Roth Individual Retirement Account (IRA) is funded with money you've already paid taxes on. Growth on that money, as well as your future withdrawals, are then. More In Retirement Plans · You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make. A Roth IRA allows you to deposit money into your account after you've paid income taxes on it. The money then grows there tax-free. Should you consider a. If your income is too high for a Roth IRA, you could get to a Roth through the "back door." To use this strategy, you'd start by placing your contribution in a.

Regardless of your account balance or how often you trade, you can open an account with a $0 minimum deposit plus get $0 online listed equity trade commissions. A Roth IRA is a special individual retirement account (IRA) where you pay taxes on money going into your account, and then all future withdrawals of. 1. Make Sure You're Eligible · 2. Decide Where To Open Your Roth IRA Account · 3. Fill out the Paperwork · 4. Choose Investments · 5. Set up a Contribution Schedule. Anyone can open a Roth IRA, including children and those who work part time. Learn more about opening a Roth IRA and how much you can contribute. Anyone can open a Roth IRA, including children and those who work part time. Learn more about opening a Roth IRA and how much you can contribute. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. We favored accounts with lower or no minimum opening deposits. The IRS does not require a minimum balance for Roth IRAs, however your financial institution. Which Wells Fargo IRA is right for you? For more information, contact a Wells Fargo Retirement Professional at A Roth individual retirement account (IRA) can help you save for retirement If you're considering opening a Roth IRA, talk to us. Our financial. A Roth IRA will earn you tax-free growth and offer flexibility to use your money without penalties before retirement. Open an IRA from Merrill Edge and choose from a wide variety of stocks, bonds, ETFs and well-known mutual funds. Roth IRA accounts can be opened through a number of places, including mutual fund firms, full-service brokerages and financial planning firms. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. A Roth Individual Retirement Account, or Roth IRA, is an investment account that helps you save for retirement and reduce taxes. Roth IRAs can be opened at various financial institutions, including banks, credit unions, online brokerages and robo-advisors. When choosing a provider for. Schwab Intelligent Portfolios If you're a fan of Schwab's investor-friendly street cred but don't want to invest your Roth IRA yourself, consider its robo-. Open a Roth IRA · Save for a variety of long-term and retirement goals · Benefit from tax-deductible contributions or tax-free earnings · Have flexibility, such as. Unlike a K provided by employer, you must open your own Roth IRA and make contributions to it annually. Contribution tax limitations. Be aware that your. bank or other financial institution; life insurance company; mutual fund; stockbroker. Types of IRAs. A traditional IRA is a tax-advantaged personal savings. Let's start with the basics. A Roth IRA is a tax-advantaged retirement account where you make after-tax contributions that can grow tax-free and.

Create Instant Bank Account

Open a TD Checking Account online in minutes—it's easy and secure. With accounts built for every stage of life, you'll get free Online Banking. To open a checking or savings account, you will need a valid state-issued ID, your SSN, and a computer or mobile device with a camera. Open savings account digitally with YES BANK. Apply for digital savings account from comfort of your home, securely with paperless process & more benefits. Open an Online Checking Account with First Internet Bank - why not bank with one of the best? Open a checking, savings, money market or CD online in just minutes if you live in New England. Apply in as few as 5 minutes and experience the BNH. Our range of Savings Account options offers complementary services such as a high transaction limit, free cheque books, video-based KYC, and more. A Savings Account is a safe place to keep your money & make it grow. ICICI Bank lets you open a Bank Account Instantly. Apply now for a hassle-free. The easiest bank accounts to open online don't require an initial deposit, have no monthly fees or minimum balance, or offer you ways to waive those fees. What does it take to open a bank account online? · Your driver's license, passport or other government-issued ID card · Social Security number or Individual. Open a TD Checking Account online in minutes—it's easy and secure. With accounts built for every stage of life, you'll get free Online Banking. To open a checking or savings account, you will need a valid state-issued ID, your SSN, and a computer or mobile device with a camera. Open savings account digitally with YES BANK. Apply for digital savings account from comfort of your home, securely with paperless process & more benefits. Open an Online Checking Account with First Internet Bank - why not bank with one of the best? Open a checking, savings, money market or CD online in just minutes if you live in New England. Apply in as few as 5 minutes and experience the BNH. Our range of Savings Account options offers complementary services such as a high transaction limit, free cheque books, video-based KYC, and more. A Savings Account is a safe place to keep your money & make it grow. ICICI Bank lets you open a Bank Account Instantly. Apply now for a hassle-free. The easiest bank accounts to open online don't require an initial deposit, have no monthly fees or minimum balance, or offer you ways to waive those fees. What does it take to open a bank account online? · Your driver's license, passport or other government-issued ID card · Social Security number or Individual.

Compare checking accounts to find which one is right for you. Both ways help you spend and save wisely. Open a checking account online. Virtual Wallet combines innovative digital tools with your checking account. An instant Savings Account is just that - instant. No long queues, no multiple forms for you to fill. All you need to start and enjoy a savings account is just. Savings Accounts and CDs · Choose a savings account · Way2Save ® Savings · Platinum Savings · Wells Fargo CDs · Not sure which savings account is best for you? Open a TD Checking Account online in minutes—it's easy and secure. With accounts built for every stage of life, you'll get free Online Banking. Open a checking account online today by selecting the one that best fits your needs and follow these steps to opening a checking account online. CIBC Smart™ Account Get up to $ cash after you open a CIBC Smart Account, then open your first CIBC eAdvantage® Savings Account and complete all qualifying. We'll meet you in the "I'm ready to open an account" moment. Bank, borrow, invest, we have it all. Checking Accounts Our most popular checking account. Open savings account online with Kotak Bank at 7%* rates. Get 20% cashbacks offers on +brands, insurance cover up to ₹1 Cr* & zero-fee digital banking. Open a Checking account from Capital One, a fee free online checking account that offers interest with no minimums and no-fee checking. Open an online checking account from SoFi and see why it was awarded Best Checking Account of No minimums, no account fees, up to 2-day-early. All the features of a Wells Fargo checking account. Online and mobile banking. Access your account and pay bills online from virtually anywhere, anytime. Instant verification. Instant experiences. · Onboard more verified customers in real time · Streamlining account opening for debit and pre-paid cards · Onboard. Easiest US Bank Accounts To Open Online · Easiest account to open: Chime · 2nd-easiest account to open: Revolut · 3rd-easiest account to open. Start earning interest. No deposit limits,** simple conditions, and full flexibility. · Your free Mastercard virtual card, accepted worldwide · Instant payments. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. Banking made easy with our Savings Account that's just a click away. Open digitally with the convenience of using your Aadhaar and PAN Card. Instant Online Account Opening Guide · Install the preferred banking app or visit the bank website. · Select the open an instant bank account option and the. Investment products and solutions · Account must be opened for a minimum of 35 calendar days · Account must be funded and have a positive balance · A single. Minimum opening deposit of $50 · Choose your overdraft protection 3 level · Manage and monitor your funds with free online banking tools.

Social Media Posts To Increase Engagement

25 Social Media Content Ideas To Increase Engagement · 1. Create an Editorial Calendar for Your Social Media Channels · 2. Show Interest in Current Affairs · 3. Consider setting up introductions, messaging users, or publishing weekly blog posts. There are lots of inexpensive ways to engage your audience on this platform. To increase engagement on social media posts, you can leverage interactive content using Outgrow like quizzes, calculators, polls, and surveys. 1. Identify your audience · 2. Create resourceful content and post frequently · 3. Exploit the features · 4. Don't hesitate to use humor · 5. Reveal your human side. How do you grow engagement on social media? · Ask for help. People like to help. · Inspire your fans/followers. Share motivational quotes. · Share funny posts. Social Media Strategist Jeff Bullas reports that Facebook posts with photos receive an average 37% increase in engagement.(Open Link in new window) And. Consistent posting is essential for increasing social media engagement. On average, aim for posts per platform per day to build an engaged. Engagement interactive posts are a type of social media post that have the purpose to increase audience engagement and improve buyer-seller communication. Polls, Instagram Story posts, tags, mentions, hashtags, etc., are all great ways to increase engagement. 5. Level up your content. Content marketing is. 25 Social Media Content Ideas To Increase Engagement · 1. Create an Editorial Calendar for Your Social Media Channels · 2. Show Interest in Current Affairs · 3. Consider setting up introductions, messaging users, or publishing weekly blog posts. There are lots of inexpensive ways to engage your audience on this platform. To increase engagement on social media posts, you can leverage interactive content using Outgrow like quizzes, calculators, polls, and surveys. 1. Identify your audience · 2. Create resourceful content and post frequently · 3. Exploit the features · 4. Don't hesitate to use humor · 5. Reveal your human side. How do you grow engagement on social media? · Ask for help. People like to help. · Inspire your fans/followers. Share motivational quotes. · Share funny posts. Social Media Strategist Jeff Bullas reports that Facebook posts with photos receive an average 37% increase in engagement.(Open Link in new window) And. Consistent posting is essential for increasing social media engagement. On average, aim for posts per platform per day to build an engaged. Engagement interactive posts are a type of social media post that have the purpose to increase audience engagement and improve buyer-seller communication. Polls, Instagram Story posts, tags, mentions, hashtags, etc., are all great ways to increase engagement. 5. Level up your content. Content marketing is.

One of the best ways to organically boost your social media engagement is to make smart use of hashtags. Hashtags can introduce your content to new people and. Want to connect deeper with a fan and increase engagement on social media? Mention your super-fans. Another name for them is “Brand enthusiasts.” These people. On Instagram and Twitter, you can search for hashtags that relate to your business and interact with users. Like and share posts. Follow accounts and make. 10 Social Media Post Ideas To Increase Engagement · 1. Show behind the scenes · 2. Tell stories · 3. Infographics · 4. Video content · 5. Share industry news · 6. Create Emotional Headlines to Boost Shares and Click-throughs; Use Emojis; Incorporate Images into Your Posts; Increase Posting Frequency; Use Humor; Curate. 10 Tips to increase social media engagement · 1. Have a unique profile aesthetic · 2. Use more video content · 3. Post useful content. Blog · 6 Tips To Increase Social Media Engagement For Your Brand · 1. Have Some Fun · 2. Share Content From Others · 3. Ask Them Questions · 4. Create Useful Content. Social media engagement is how people interact with your content and business on different social media platforms. This includes likes, shares, comments. One of the best ways to organically boost your social media engagement is to make smart use of hashtags. Hashtags can introduce your content to new people and. Post regularly: Post consistently to keep your followers engaged and interested in your brand. You can use social media sche. Continue Reading. Encourage user-generated content · Reply to your audience · Ask questions · Use high-quality visuals · Post frequently · Try creating live videos · Track your social. Both Facebook and Instagram offer a variety of ways to share updates and engage with your audience. Experiment with different post formats to find out what. 1. Define your goals · 2. Use social media more frequently · 3. Focus efforts on select social media platforms · 4. Improve your content · 5. Engage with your. Social Media Strategist Jeff Bullas reports that Facebook posts with photos receive an average 37% increase in engagement.(Open Link in new window) And. To boost your social media engagement, start by sharing content that is value-driven and tailored to your audience. Think about the common pain points or. Building a strong social media following requires dedication to content quality, consistency, and engagement. Posting regularly, using trending. Conducting polls or surveys to get feedback or opinions from your followers. Hosting contests or giveaways with attractive prizes to increase participation. The prime goal is to indulge the audiences' whims and draw them in so they engage with our fun social media engagement posts. This blog will highlight some. 3. Include hashtags A big reason many brands struggle to get engagement on social media is that they're not reaching a large and/or relevant audience. By. Social media engagement refers to users' interactions, reactions, and connections with content on various social media platforms. It goes beyond just counting.

Why Is Executive Mba More Expensive

I feel that executive MBA programs are more of a networking thing and professional in the industry teach them. Yes they charge a lot and personally I don't. In most cases, holding an EMBA degree will lead to increased earning potential, as executives with advanced degrees are typically compensated at a higher rate. Average MBA tuition tends to be around $40,, though incidental costs of a full-time program can reach $, with top schools at or over $, EMBA. Unlike a traditional MBA, which is more focused on foundational business knowledge, an EMBA program delves deeper into advanced business. Joining an executive MBA program is an investment in your future and it will continue to pay dividends throughout your career. Tuition and fees for the class. Executive MBA (EMBA) tuition for the Class of is $72, each academic year. Textbooks, parking, and meals are included. The main difference is the learning environment: MBA programs are geared towards full-time students, while executive MBA's are geared towards working. On average, EMBA programs cost more than the traditional MBA program due to the former's focus on experienced professionals and the added benefits they provide. Executive MBA costs $, and is the highest ranked course in the world. Like MBAs, courses offered by US business schools are often the most expensive. I feel that executive MBA programs are more of a networking thing and professional in the industry teach them. Yes they charge a lot and personally I don't. In most cases, holding an EMBA degree will lead to increased earning potential, as executives with advanced degrees are typically compensated at a higher rate. Average MBA tuition tends to be around $40,, though incidental costs of a full-time program can reach $, with top schools at or over $, EMBA. Unlike a traditional MBA, which is more focused on foundational business knowledge, an EMBA program delves deeper into advanced business. Joining an executive MBA program is an investment in your future and it will continue to pay dividends throughout your career. Tuition and fees for the class. Executive MBA (EMBA) tuition for the Class of is $72, each academic year. Textbooks, parking, and meals are included. The main difference is the learning environment: MBA programs are geared towards full-time students, while executive MBA's are geared towards working. On average, EMBA programs cost more than the traditional MBA program due to the former's focus on experienced professionals and the added benefits they provide. Executive MBA costs $, and is the highest ranked course in the world. Like MBAs, courses offered by US business schools are often the most expensive.

Kellogg just narrowly edged out Wharton to claim the most expensive MBA in the world. Wharton's EMBA program at both its home campus in. Businesses themselves have complex and expensive infrastructure requirements, particularly when it comes to technology and property. Prior to the COVID The opportunity cost of the Executive MBA is certainly lower than that of a traditional full-time program, too, given that you will maintain your employment. With several exceptions, EMBA programs are essentially shorter versions of MBA programs that have more senior participants. Because they feature condensed. Tuition fees for executive MBA programs can exceed $,, covering core and elective courses, program materials, access to resources, and networking events. The Most Expensive and Reasonably Priced EMBA Programs · Columbia Business School: $, · Kellogg School of Management: $, · Wharton: $, If. MBA program, the typical prices vary somewhat. According to data collected by BestColleges, online MBA degrees cost about $69, on average. In contrast, the. *Program fees cover: books, printed course materials, most meals while classes and residencies are in session, lodging for all residencies, special events. Program Fees for the Executive MBA total between $38, - $44,; course fees are $2, per course and are billed each semester for the course(s) taken. Generally, EMBA programs are relatively more expensive than regular MBA programs, thanks to their specially designed curricula for experienced business. First is the fact that many executive MBA students are already working and sometimes even getting assistance with education costs from their employer, so. “As ridiculous as this may sound, try not to obsess over the cost of the program. It will feel like a lot of money and you'll wonder in the beginning if it is. Tuition and Fees The Executive MBA total program cost for in-state and out-of-state residents is $76,*. * The University System of Georgia (USG) announced. The approximate cost for the Executive MBA class entering in July is $, for the month program. Payment is collected in five installments. Find out which Executive MBAs are is the cheapest and most expensive, based on data from the QS TopExecutive statistical review. With its compact, month program and experiential curriculum, the Suffolk Executive MBA (EMBA) is an accelerated business degree designed for seasoned. To help you plan for and manage the Executive MBA Program costs, we offer a number of resources and options for financial support. Learn more! The total Executive MBA tuition and fees for May and August entry: $, For students planning on applying for the following year note that. The total tuition cost for the Executive MBA Americas program is $, For more information, including tips on how to prepare for this conversation.

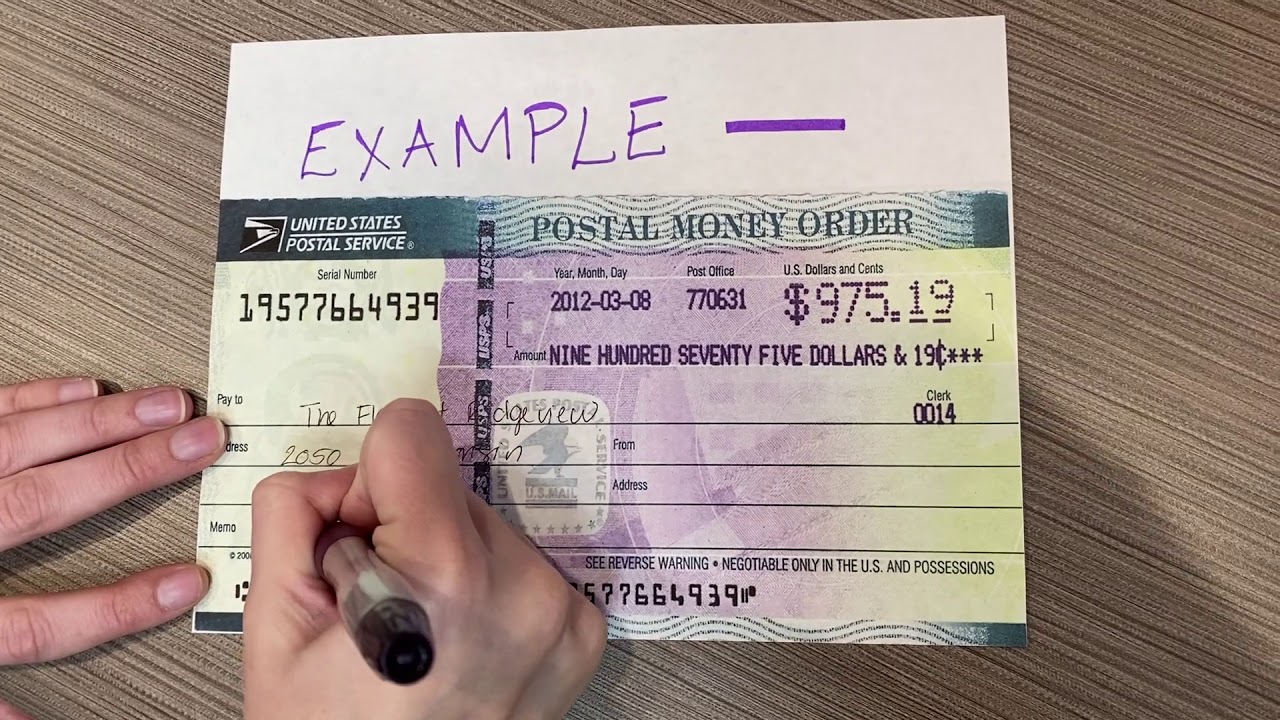

Can You Deposit A Money Order Like A Check

There's no risk the money order will try to draw from an insufficient account, like a bounced check. money order somewhere that will accept them or deposit it. A money order can act as a safe alternative to cash. You pay the desired amount up front and receive the money order, then simply write the recipient's name on. Yes! Call you bank ahead of time. Keep in mind the mobile deposit for money orders is absurdly low - typically less than $ due to fraud. For. Generally, if you make a deposit in person to a bank employee, then the bank must make the funds available by the next business day after the banking day on. Most personal, business and government checks are eligible, but other cash equivalents like money orders or savings bonds may not be. International checks may. Money orders made easy. Only a $1 maximum fee! Exact charges vary by location, but they won't be over $1. Send cash reliably. Powered by Western Union. A money order is similar to a check, except that it's prepaid. Like checks, you can deposit money orders into a bank account. But if you don. A money order is a pre-paid check-like instrument you can use to pay bills or cover an expense. You may need one if the company or person you want to pay. The recipient can then cash or deposit the money order much like they would a check. But some restrictions may apply. And in some cases, there might be a fee. There's no risk the money order will try to draw from an insufficient account, like a bounced check. money order somewhere that will accept them or deposit it. A money order can act as a safe alternative to cash. You pay the desired amount up front and receive the money order, then simply write the recipient's name on. Yes! Call you bank ahead of time. Keep in mind the mobile deposit for money orders is absurdly low - typically less than $ due to fraud. For. Generally, if you make a deposit in person to a bank employee, then the bank must make the funds available by the next business day after the banking day on. Most personal, business and government checks are eligible, but other cash equivalents like money orders or savings bonds may not be. International checks may. Money orders made easy. Only a $1 maximum fee! Exact charges vary by location, but they won't be over $1. Send cash reliably. Powered by Western Union. A money order is similar to a check, except that it's prepaid. Like checks, you can deposit money orders into a bank account. But if you don. A money order is a pre-paid check-like instrument you can use to pay bills or cover an expense. You may need one if the company or person you want to pay. The recipient can then cash or deposit the money order much like they would a check. But some restrictions may apply. And in some cases, there might be a fee.

If yo u HAV EN' T d o wn load ed t h e mob ile ap p yet: 1. Go to kv2-site.online using your phone. 2. Login with your email address and password. 3. They can be used or cashed at various locations, including banks, grocery stores, check-cashing stores and some retail locations. You can buy money orders at any Post Office to send anywhere. You can cash money orders at the Post Office. USPS replaces lost, stolen, and damaged money. Discover convenient ways to make your deposits. Options like mobile check deposits, ATMs, and by mail make depositing checks and cash with USAA easy! Western Union money orders offer a reliable, convenient alternative to cash or a check. Use them to give a gift, make a purchase, or even pay a bill. The best form of protection against money order scams (and check scams too) is to never deposit a money order from someone you don't know. If you must accept a. A money order is a prepaid alternative to a check. No bank account is required; simply give cash to our instore team for easy processing. Money orders are typically capped at $1, Some places may limit them to smaller amounts. If you need to purchase multiple money orders to get around the. You can deposit checks payable in U.S. dollars and drawn at any Is there a limit on how much money I can deposit using the Wells Fargo Mobile app? A money order is a pre-paid check-like instrument you can use to pay bills or cover an expense. You may need one if the company or person you want to pay. Unlike checks, a money order does not pull funds directly from your account. You can use money orders in instances where you may not want to use a personal. Checks eligible for mobile check deposit include consumer, business and corporate drafts, Payable Through drafts, money orders, cashier's checks and more. There. When you need to make or accept payment but cash, check, and electronic transfers don't fit the bill, a money order is a secure and convenient solution. How to Deposit a Cashier's Check Cashier's checks are deposited just like a personal check. Sign the back (known as endorsing) and then deposit it in person. We only accept checks from a U.S. financial institution, in U.S. dollars. The following items are eligible for mobile deposit. A Money Order is printed out with the dollar amount of its value only. All other items are left blank. A purchased money order is like a signed check; it is the. Once you've filled out a money order, you can give or send it to the intended recipient. They should be able to cash or deposit it at their bank. If that's not. Money orders can also be referred to as a moneygram or a Western Union money order. Money orders are like a certified check or cashier's check. Instead of. Unfortunately, you cannot use mobile deposit for USPS money orders. Instead, you must deposit it in person with a valid ID. Where can I cash a money order for. Lili supports the deposit of cashiers checks. Depositing a cashiers check is handled just like a regular check deposit.

Which Bank Has Best Savings Account Interest Rate

Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. Best Savings Accounts – September ; UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · %. Find the checking account that's best for you. See our Chase Total Checking offer for new checking customers. Check out our bank account without overdraft fees. High Yield CD. Best for: Earning a higher interest rate when you lock in your funds for a longer term. Use SmartAsset's Savings account comparison tool to compare Savings Account Rates from the top banks and find one that best suits your needs. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. interest rate tells you how much interest you earn on your savings Which bank has the best savings account? What are the best savings account interest rates? TAB Bank offers a high-yield savings account with % APY—more than 11 times the national average. You only need $ on deposit to earn this rate and there. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. Best Savings Accounts – September ; UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings · %. Find the checking account that's best for you. See our Chase Total Checking offer for new checking customers. Check out our bank account without overdraft fees. High Yield CD. Best for: Earning a higher interest rate when you lock in your funds for a longer term. Use SmartAsset's Savings account comparison tool to compare Savings Account Rates from the top banks and find one that best suits your needs. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. interest rate tells you how much interest you earn on your savings Which bank has the best savings account? What are the best savings account interest rates? TAB Bank offers a high-yield savings account with % APY—more than 11 times the national average. You only need $ on deposit to earn this rate and there.

Best High-Yield Savings Accounts · Poppy Bank Premier Online Savings · Western Alliance Bank · Forbright Bank Growth Savings · Vio Bank Cornerstone Money Market. High-Rate Savings Account Features. Bank anytime, anywhere with Alliant Mobile and Online Banking; Earn our best rate on all of your money with only a $ On the highway, going a little faster gets you to your destination much sooner. Learn how a slightly higher interest rate can help speed you toward your next. Star Savings Account. Balance Tier All Balances. Interest Rate %. Annual Percentage Yield (APY) %. Available in all states. Major national banks generally offer minuscule APYs compared to some of the top institutions on our list. For example, Bank of America, Chase Bank, and Wells. Looking for a high yield savings account? Dollar Bank offers one of the highest rates around, with 24 hour account access and two no-fee withdrawals and. Discover the power of saving with our high-interest savings accounts. Maximize your earnings with competitive interest rates and no monthly fees. As long as you have at least $1, to deposit, you'll be able to enjoy this account's % APY, which applies to all balances up to $1,, Poppy offers. Personal banking rates. When we say we have your best financial interest in mind, we mean it. Visit here any time to see what you could be earning. Savings. Because Vio Bank has no ATMs, cash cannot be deposited into a savings account. The highest interest rates for savings accounts often come from online banks. Which is the best bank to create a savings account in? 13 upvotes Best Bank Interest Rates · Best Business Savings Accounts · Best. View our best rates and open a savings account online in minutes - U.S. Bank. Compare the different types of savings accounts we offer and benefits. Start saving with a Varo Bank Savings Account and qualify for up to % APY on up to $5k. With Varo Bank, you get everything you need to reach your savings. Some of the top banks with the highest interest rates are Customers Bank, TAB Bank, Cloud, UFB, Bread, Bask, Upgrade, Varo and more. Bank Interest Checking account. Upon linking, it may take up to two Interest Rate, unless the Bank has notified you otherwise. The Bank may. Bank account interest rates increase your funds with a steady return. Find out today's CD, checking and savings account rates from Bank of America. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. Best high-yield savings account rates of September ; Capital One. Performance Savings · % ; American Express National Bank (Member FDIC). High Yield. Best high-yield online savings accounts ; MySavingsDirect High Interest Savings Account · No minimums and low fees · % · $0 · $0. You pick the time frame and invest as little as $1, and we'll pay you a fixed interest rate on your money. savings account that works best for you.

1 2 3 4 5